Spend more: People wait for transport after buying food with child grants. A universal income will boost the country’s economic recovery. Photo: Per-Anders Pettersson/Getty Images

The question whether the government is spending too much is a relative one. Relative in terms of actual amount spent, and on the allocation principle versus the magnitude of the problem one is trying to solve for.

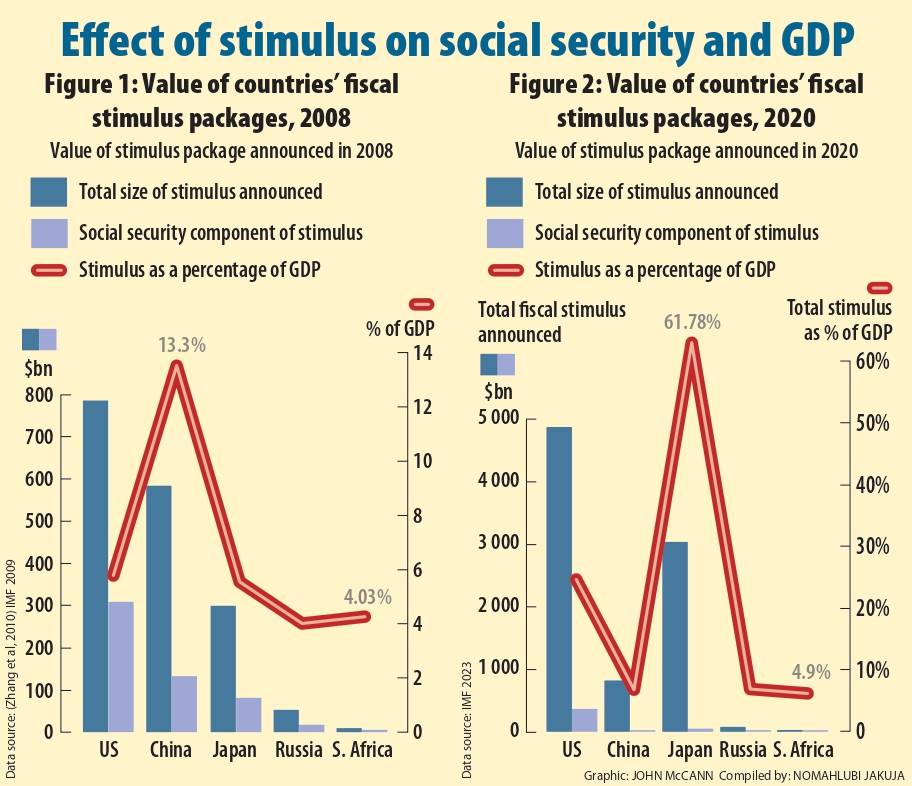

In this article we look at how much the South African government allocated to fiscal spending during two crises, the 2008 financial crisis and the Covid-19 pandemic. We compare the announced spending (amount) in relation to other countries and we also compare the portion of the amount that went to social security (allocation).

Thirty years into democracy, the country has a 41.1% (Q4 2023) rate of unemployment, with young black women disproportionately affected by unemployment. South Africa is the most unequal country in the world with a Gini coefficient of 0.63.

To address this, the Social Policy Initiative calls for a universal basic income as one of seven pillars needed to address unemployment, poverty and inequality. We call for the implementation of a universal basic income for adults and children valued at R862.9 billion over three years — R557.7 billion for adults and R305.2 billion for children who received a means-tested child support grant of R505 a month during 2023-24.

The child support grant, which reaches about two-thirds of all children, must be universal, but this paper uses statistics from the treasury in the 2023 medium term budget policy statement.

Assuming a 70% uptake, the number of universal basic income adult beneficiaries will be 25 million in 2024-25, 25.4 million in 2025-26 and 25.8 million in 2026-27, using Statistics South Africa’s 2022 population projections. Child support grant beneficiaries will be 13.7 million in 2024-25, 13.9 million in 2025-26 and 14.1 million in 2026-27.

The narrative from leading government departments such as the treasury is that South Africa is spending a lot already. To give a counter-argument, we collected data on fiscal stimulus packages and compared South Africa’s package to other countries, as well as the proportion of the spending that goes to social security. We found that the amount allocated by South Africa to social security was minimal compared to what other countries allocated.

Prior to the Covid-19 pandemic, the 2008 global financial crisis was the event where countries around the world pursued fiscal stimulus packages to recover from crises. In 2008 the United States had the largest fiscal stimulus value at $787 billion, followed by China with $585 billion and Japan with $298 billion. India’s stimulus package was $38.9 billion and Russia’s $53.6 billion. South Africa injected $9.9 billion (See Figure 1). These packages exclude financial measures such as government guarantees and public loans, financial bailouts, measures taken by central banks, and the acquisition of securities and loans issued by the private sector.

The packages include only discretionary measures announced. Fiscal policy including both automatic stabilisers and crisis-related spending play an important role in cushioning against exogenous shocks and as overall economic growth policies. The composition, size and frontloading of the stimulus determine the effectiveness of the fiscal stimulus.

Measures that constitute social security vary from country to country. In this article social security components measured in each stimulus package is defined as any policy intervention intended to reduce poverty and vulnerability, especially vulnerability induced by economic shock.

Compared with its peers, South Africa’s fiscal stimulus package in 2008 was significantly lower, with the proportion allocated to social security even lower. The stimulus as a percentage of GDP measured 4.03%. In the same year the annual real GDP growth rate was -1.5%. The inflation rate was 7.1%.

(Graphic: John McCann/M&G)

(Graphic: John McCann/M&G)All other things being equal, the bigger the size of the fiscal stimulus, the bigger the rate of GDP growth should be accounting for the spending multiplier. From Figure 1 we can see countries that had a higher fiscal stimulus and a larger portion of it allocated to social security also reported higher levels of GDP in the same year.

Figure 2, accounting for time for the package to kick in, also shows higher levels of GDP growth rates in the same countries over time.

South Africa’s past fiscal expenditure has been low relative to other countries. Relative to its high unemployment rates and high inequality rates South Africa should be spending more.

Countries such as the United States and Japan, with much lower unemployment rates, spent relatively more than South Africa during both economic crises.

As South Africa makes economic and social plans for the next administration to build the country, social security presents a previously untapped opportunity to grow the economy while addressing the social ills of the country. A universal basic income must be part of such a plan for the economy. It is primarily about economic recovery and growth, not redistribution or reducing inequality, although it will help to achieve these objectives. A universal basic income becomes sustainable in the context of a significantly higher GDP growth rate and generates the resources to mostly pay for itself.

Nomahlubi Jakuja is the head of research at The Social Policy Initiative.

2 weeks ago

72

2 weeks ago

72